Data

Banking Sector Data

Banking Sector Data

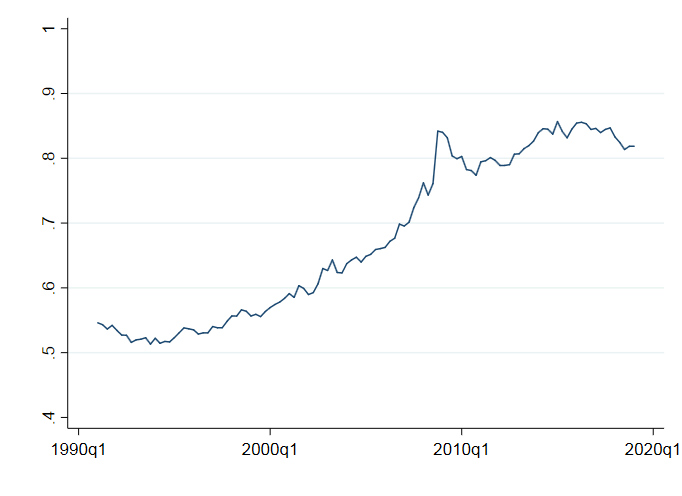

The total assets of the banking sector, as a fraction of GDP, increased steadily between 1990 and 2008, before plateauing in recent years. Source: Flow of Funds

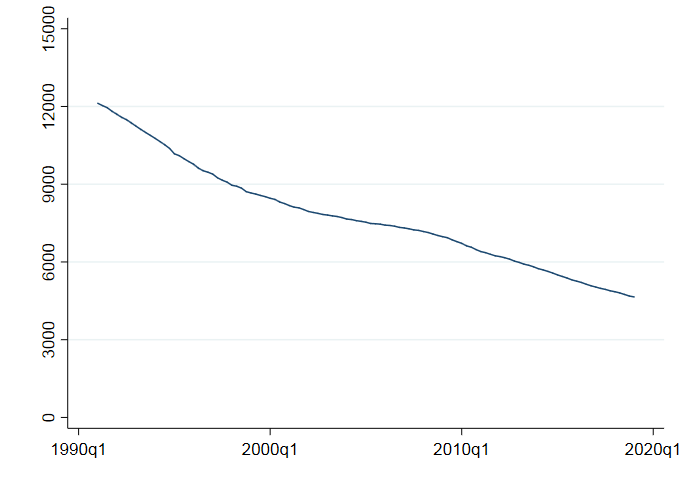

The number of commercial banks has been decreasing steadily. Source: Flow of Funds

Banking Sector Balance Sheet

Banking Sector Balance Sheet

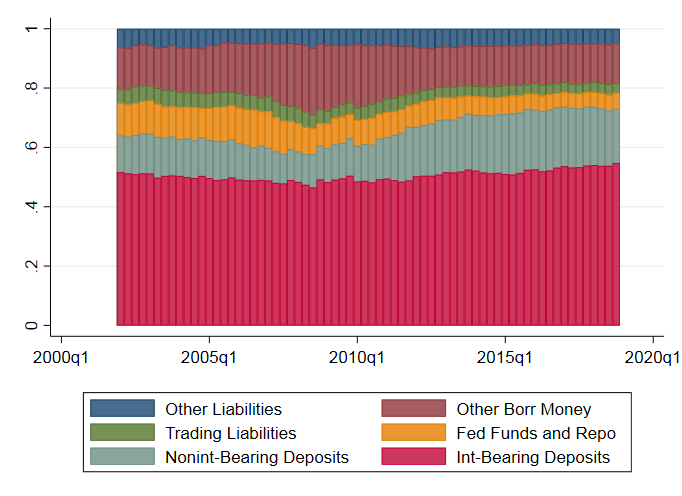

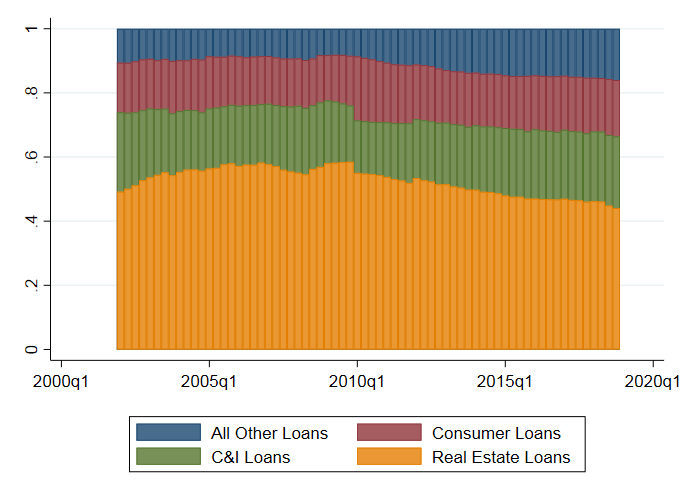

Source: Bank Holding Company Y9C Data

Source: Bank Holding Company Y9C Data

Source: Bank Holding Company Y9C Data

Banking Sector Profitability

Banking Sector Profitability

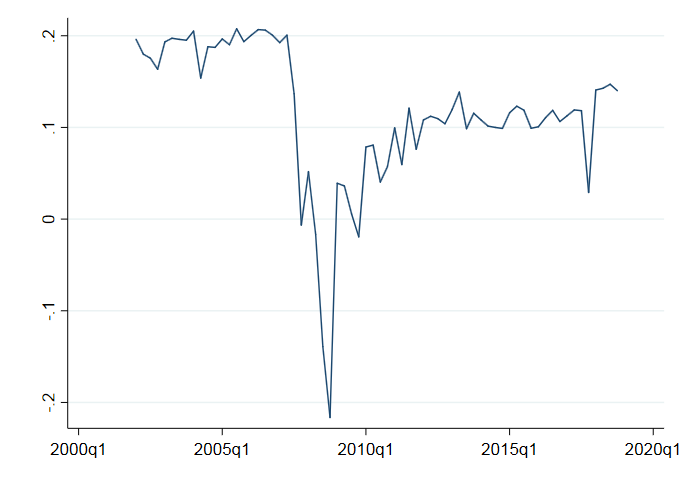

Return on equity (ROE) has rebounded from its lows during the financial crisis and has remained steady since then. ROE is defined as net income divided by average Tier 1 capital. Source: Bank Holding Company Y9C Data

Unlevered return on assets (ROA) has rebounded from its lows during the financial crisis but remains much lower than its pre-crisis highs. Unlevered ROA is defined as net income and interest expense divided by average assets. Source: Bank Holding Company Y9C Data

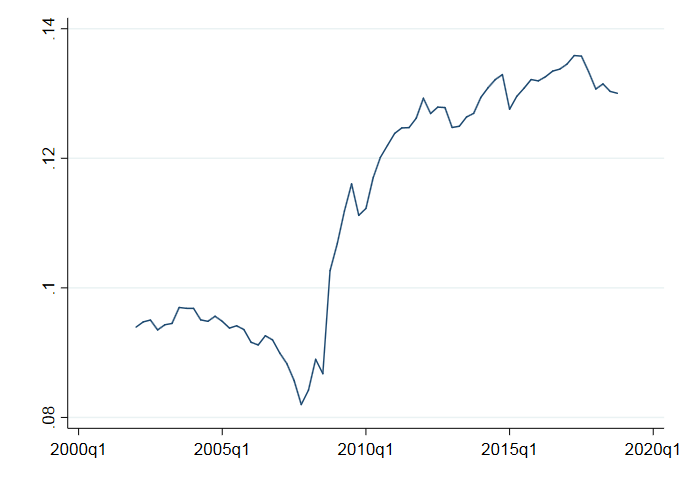

The aggregate Tier 1 ratio is much higher than its pre-crisis lows, driven by new capital regualtion. The Tier 1 ratio is defined as tier1 capital divided by assets. Source: Bank Holding Company Y9C Data

Interest and Non-Interest Income

Interest and Non-Interest Income

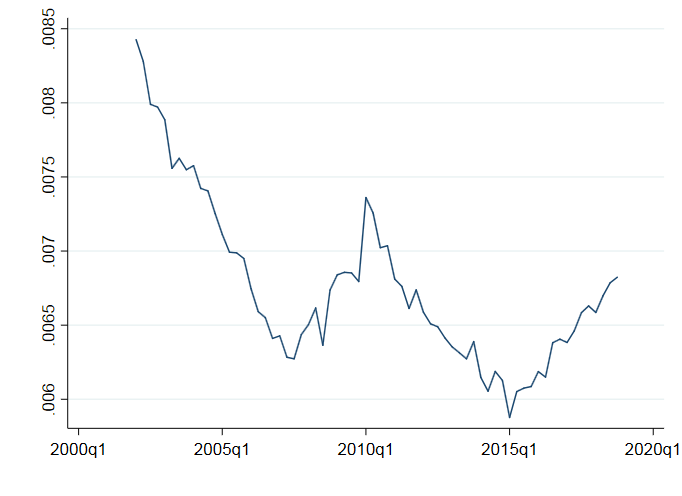

The net interest margin (NIM) peaked prior to the financial crisis and has been steadily increasing in recent years. NIM is defined as interest income minus interest expenses, divided by assets. Source: Bank Holding Company Y9C Data

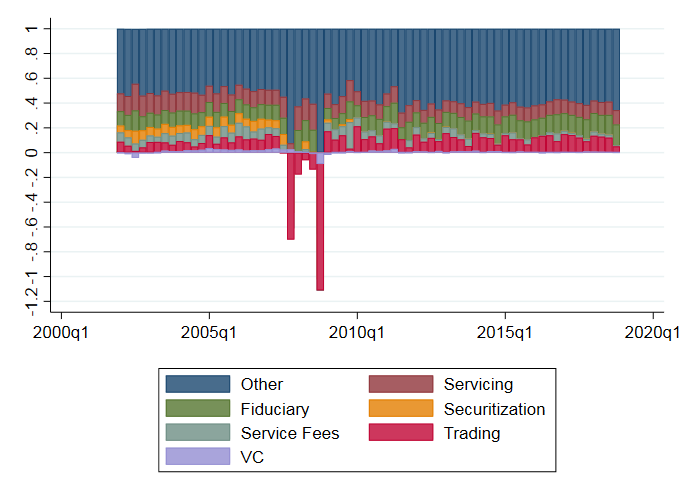

This figure displays the components of non-interest income. Income from trading activities was strongly negative in several years during the financial crisis. Source: Bank Holding Company Y9C Data

Accounting Measures of Risk

Accounting Measures of Risk

The ratio of risk-weighted assets to assets decreased after the financial crisis, before increasing in recent years. Source: Bank Holding Company Y9C Data

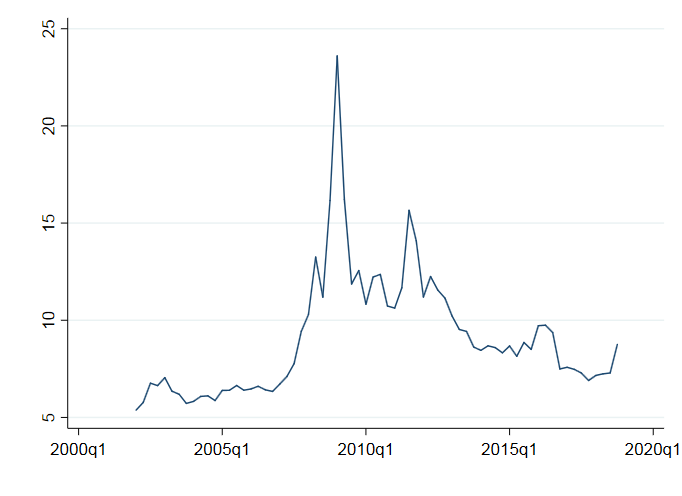

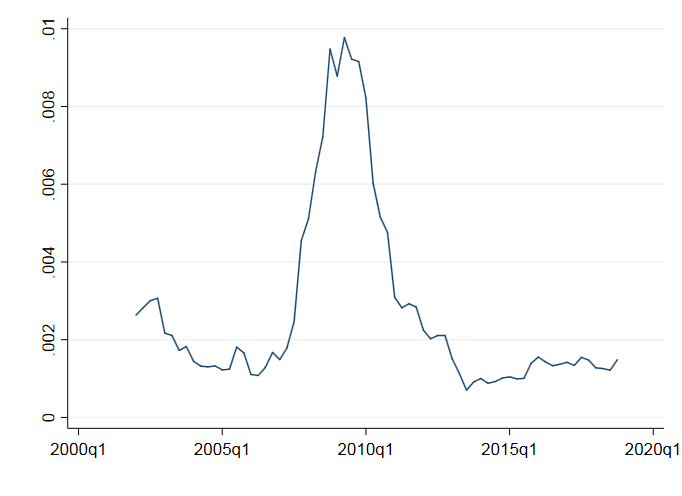

After peaking during the financial crisis, loan loss provisions as a fraction of loans plummeted and remain low. Note that loan loss provisions in the early period of the financial crisis were low, despite subsequent large loan losses. Source: Bank Holding Company Y9C Data

Market Measures of Risk

Market Measures of Risk

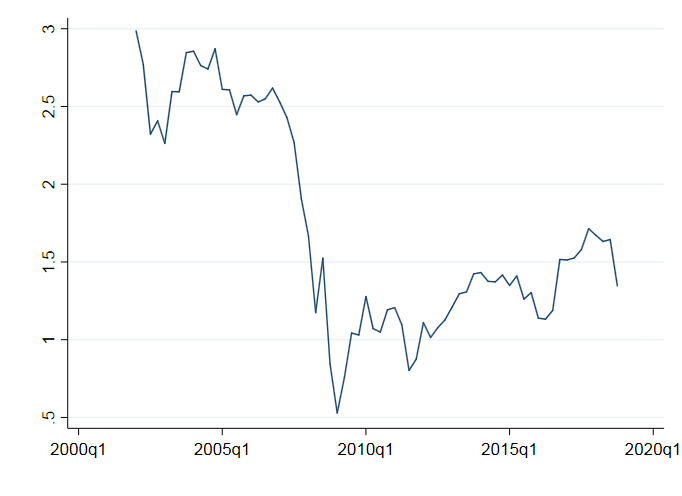

The ratio of market cap to tier1 capital (aggregated across public banks) remains much lower than pre-crisis highs. Source: Bank Holding Company Y9C Data

Market leverage is defined as the total liabilities plus market capitalization as a fraction of market capitalization, aggregated across public banks. Source: Bank Holding Company Y9C Data