2018 Financial Risk and Regulation Survey

2018 Financial Risk and Regulation Survey

1. Survey Background

In October of 2018, Harvard Business School hosted The Global Financial Crisis: What We Learned, Where We're Headed, a conference that brought together hundreds of industry experts, policy makers, HBS faculty members, and leading HBS alumni to examine and reflect on the events of the fall of 2008. In preparation for this event, the Behavioral Finance and Financial Stability Project (BFFS) at HBS conducted the 2018 Financial Risk and Regulation Survey. The anonymous survey was sent out by email to the hundreds of participants of the conference to gather their views on current sources of risk to the financial system, as well as on recent and potential regulatory changes.

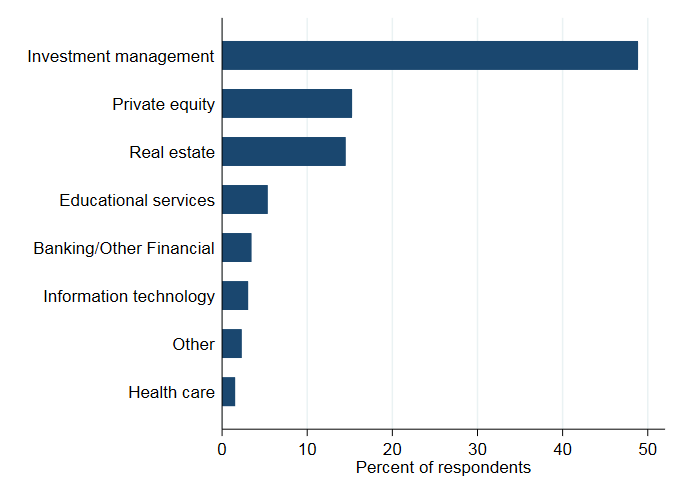

The survey was completed by 139 participants, with a variety of backgrounds and experiences, but most were financial industry professionals located in the U.S.. More than 80% of the participants listed investment management, real estate, private equity, or banking as their industry.

Figure 1: Share of Respondents by Industry

The respondents identified as knowledgeable and informed about topics of the survey. 79% answered that they agreed somewhat or completely with the statement: "I have spent a great deal of time thinking about current risks to the economy." Similarly, 77% agreed somewhat or completely with the statement: "I have a spent a great deal of time thinking about the crisis of 2007-2009 and its causes and effects."

2. Current Sources of Risk

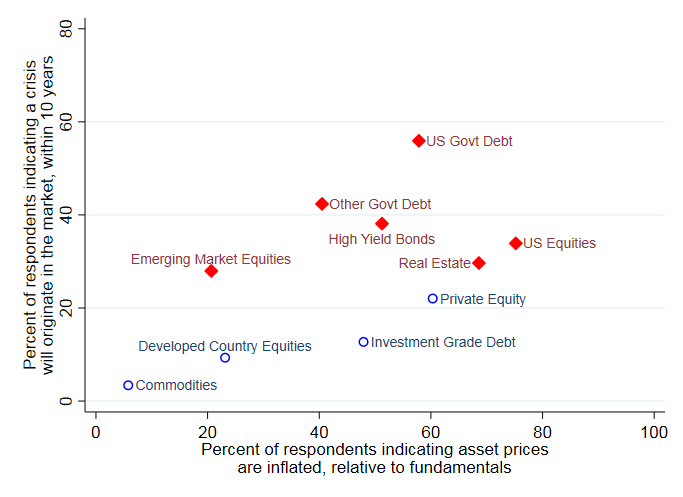

The survey asked the participants a number of questions regarding current sources of risk to the financial system. Participants identified asset prices in several markets as particularly inflated, relative to fundamentals, including U.S. government debt, other government debt, high yield bonds, real estate, and private equity. Generally, these same markets were identified as likely to originate a crisis in the next ten years.

Figure 2: Current Sources of Risk, by Market

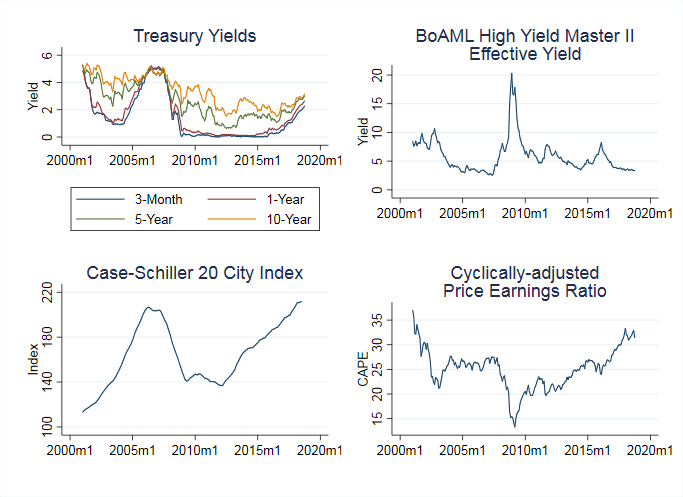

Figure 3 presents some evidence on the risk in these markets. The top left figure displays treasury yields at different maturities, and shows that yields, particularly short-term yields, have begun to rise over the recent time period. This is in line with expectations that the Federal Reserve will raise interest rates. The top right figure shows the yield on the Bank of America Merrill Lynch index of high yield bonds, which remains fairly low. The bottom left and bottom right figures present the Case-Shiller 20 city index, a measure of real estate prices, and the cyclically-adjusted Price Earnings Ratio (CAPE), a measure of stock market valuation. The average CAPE from 1900 through 2017 is 16.9; it is currently 31.5.

Figure 3: Risk in U.S. Government Bond, High Yield, Real Estate, and U.S. Equity

Markets

Sources:Data for Treasury yields, BoAML yield, Case-Schiller index from St. Louis

Fed FRED database; data for PE ratio from Robert Schillers website

Sources:Data for Treasury yields, BoAML yield, Case-Schiller index from St. Louis

Fed FRED database; data for PE ratio from Robert Schillers website

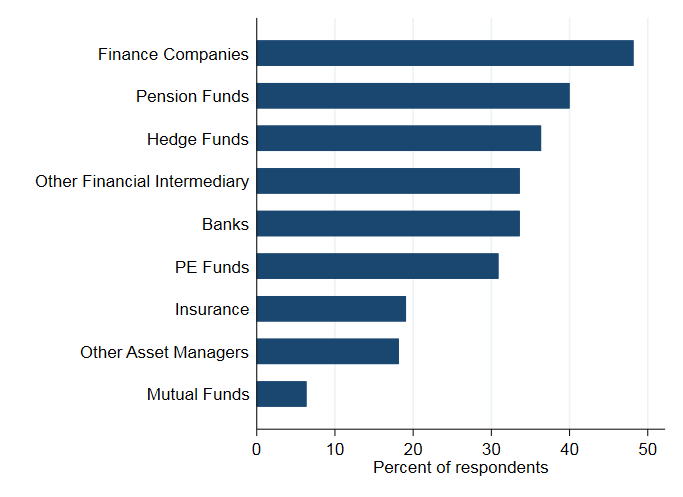

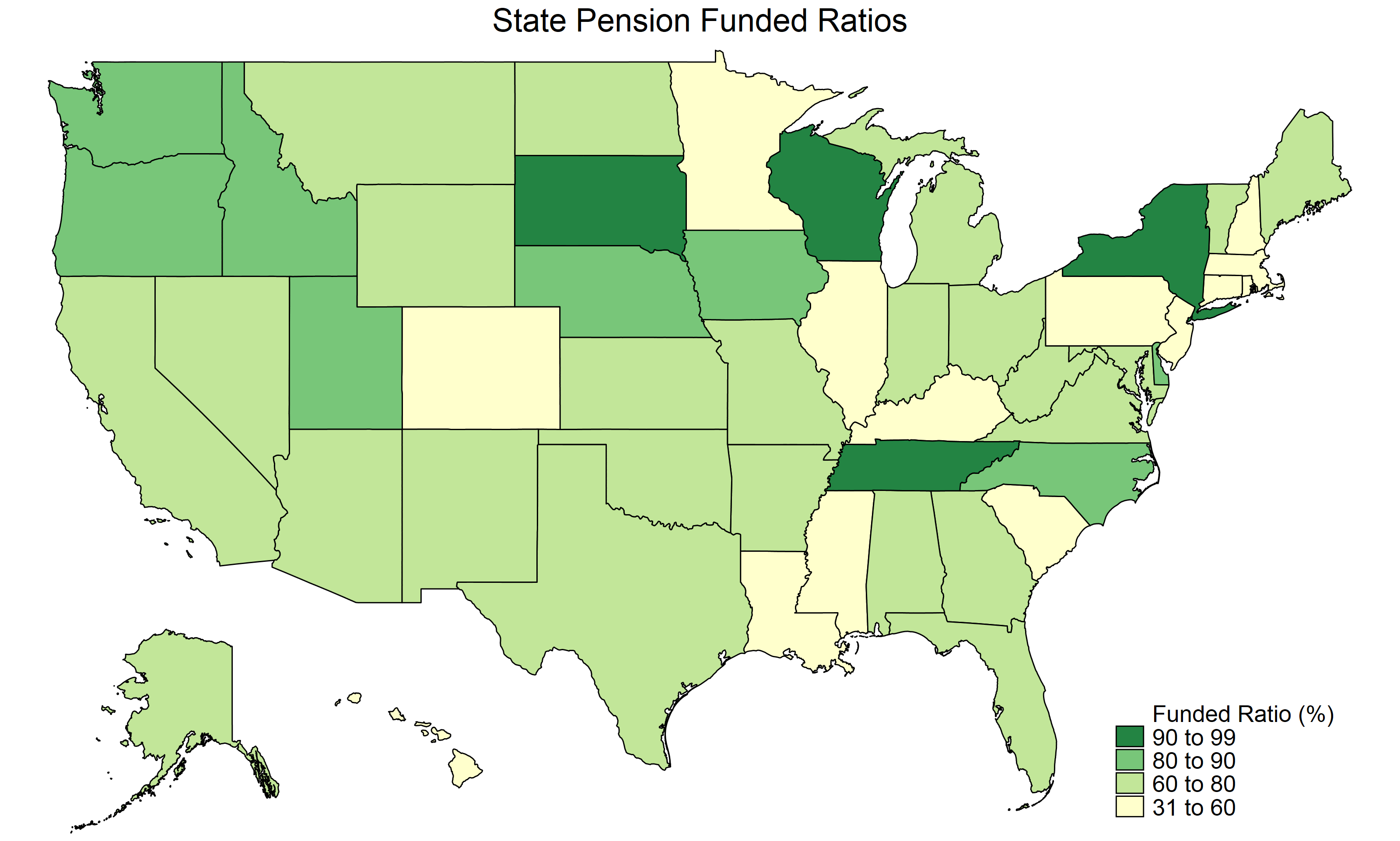

Consistent with their positive views on the effectiveness of the bank-focused regulation passed since 2008, discussed below, participants rated banks as only moderately likely to be at the center of a financial crisis within ten years. "Shadow banking" institutions such as finance companies and other financial intermediaries, and hedge funds rated more highly as sources of risk. In addition, 40% of participants stated that pension funds would be at the center of a financial crisis within ten years, consistent with the poor funding conditions of many state pension funds (see Figure 5).

Figure 4: Will any of the Following Intermediaries be at the Center of a Financial Crisis,

Within 10 Years?

Figure 5: Most State Pensions are Underfunded

Sources: Data from Pew Charity Trusts review of financial reports and public documents.

Sources: Data from Pew Charity Trusts review of financial reports and public documents.

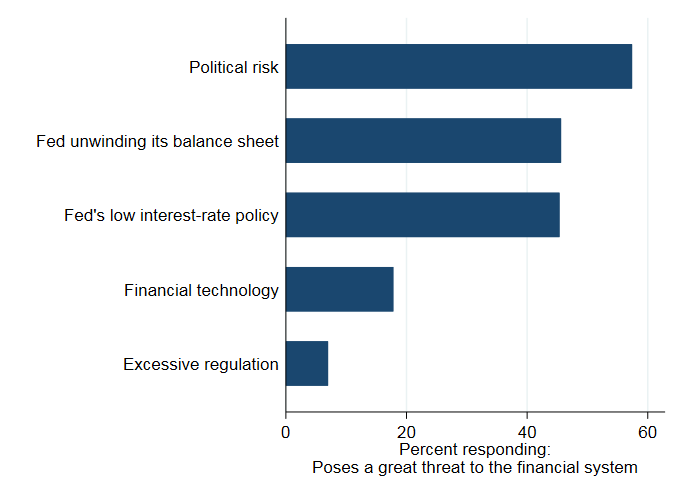

Biggest Threats to the Financial System

The participants were next asked to rate several specific threats to the financial system, including market turmoil due to political risk, The Federal Reserve unwinding of its balance sheet, the Federal Reserve's low interest rate policy, the rapid growth of under-regulated financial technology firms, and the under-provision of credit due to excessive regulation. Figure 6 presents the results. Almost 60% of respondents identified political risk as posing a great threat to the financial system, and almost 50% stated that the Federal Reserve's actions pose a great threat. By contrast, less than 10% stated that under-provision of credit due to excessive regulation posed a great threat to the financial system.

Figure 6: In Your View, Do Any of the Following Pose a Threat to the U.S. Financial

System?

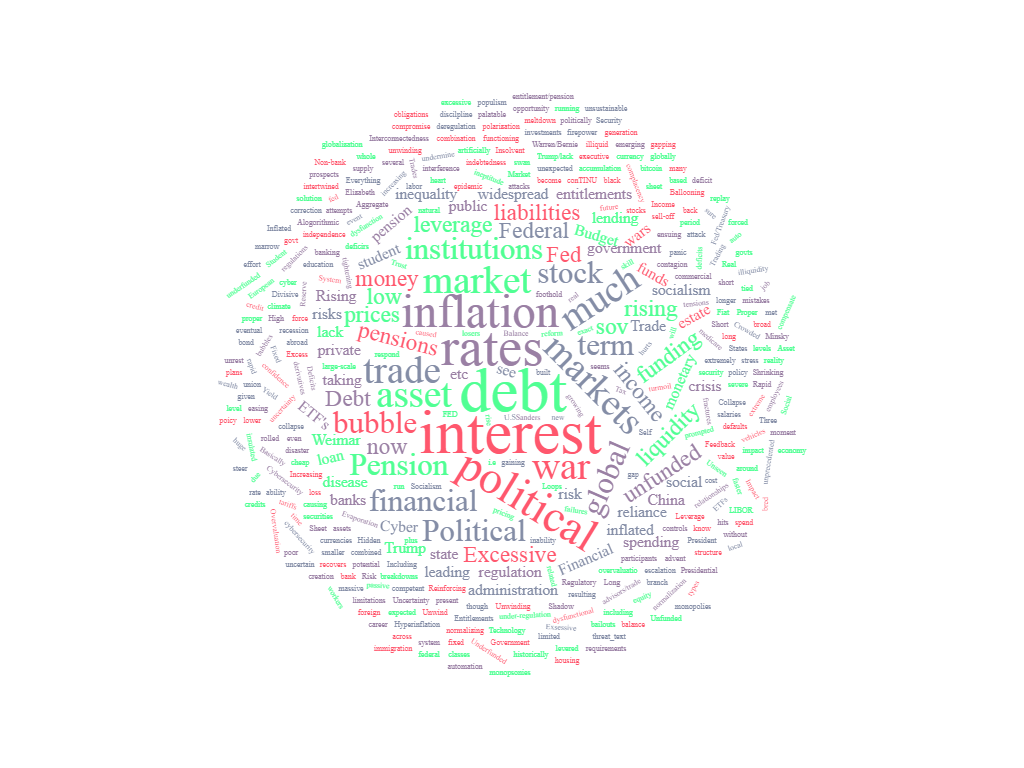

These two main concerns - political risk and high debt and low interest rate environment - were the prevailing themes of the portion of the survey focusing on current risks to the financial system. When responding free-form to the question "What are you most worried about?", respondents' answers fell into these two main categories. 31% of respondents cited increasing public and private debt as their biggest concern. They mentioned the large government deficits in the U.S. and Europe, and massive unfunded pension liabili ties, as well as high private-sector leverage. Many stressed the role of the low interest rate environment and the possibility of eventual in ation, due to the deficits and the Federal Reserve's unwinding of its balance sheet. The other main concern - cited by 26% of respondents - was political risk. Respondents worried about breakdowns in trade and market turmoil due to political instability. Some also cited the rise in popularity of socialist policies as a worry. Figure 7 presents a visualization of the words respondents used when answering the question of what worried them most.

Figure 7: What Are You Most Worried About?

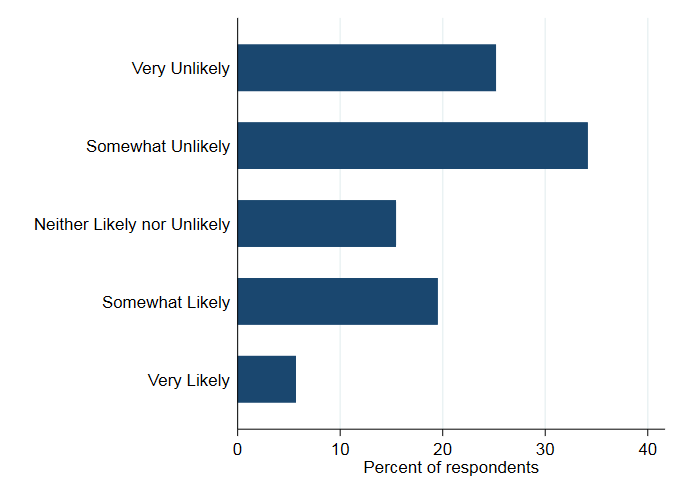

Is a Crisis Pending?

Despite these concerns, respondents did not believe that a crisis is pending. Less than 25% stated that they believe a crisis is very likely or somewhat likely within the next 12 months. However, consistent with the results of Figure 2, 50% of respondents working in the private equity and real estate industries stated a crisis is very likely or somewhat likely within the next 12 months.

Figure 8: How Do You Evaluate the Likelihood That a Crisis

Is Imminent and Will Happen Within the Next 12 Months?

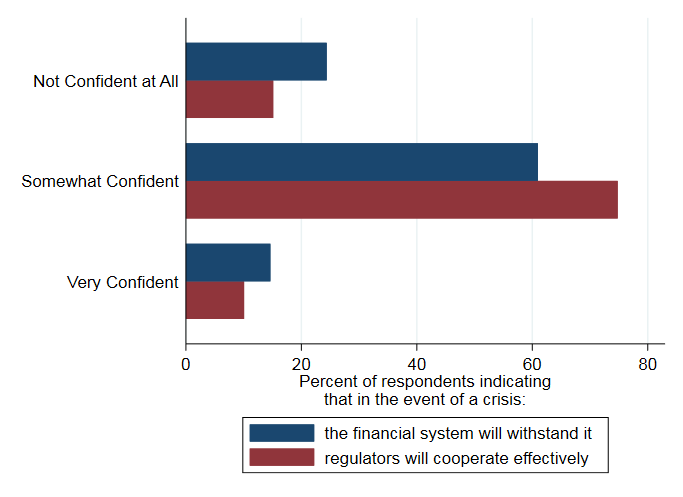

Overall, respondents were also confident that, even if a crisis did occur, the financial system could withstand it. Less than 25% of respondents were not confident that the financial system could withstand a crisis, and less than 20% were not confident that regulators would cooperate effectively. Not surprisingly, these percentages jump to 40% and 25%, respectively, for respondents who believe a crisis will happen within 12 months. Nevertheless, the majority of respondents, even among those who believe a crisis is impending, were confident in the financial system.

Figure 9: What Are You Most Worried About?

3. Reflections on the Financial Crisis of 2007-2009 and Its Aftermath

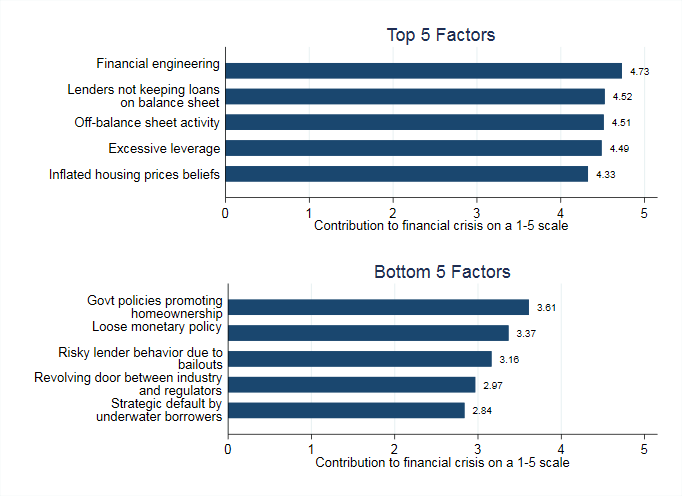

In addition to asking participants about current risks to the U.S. financial system, the survey also asked about the ffnancial crisis of 2007-2009. When asked about the 19 potential factors that contributed to the crisis (see survey text), respondents identified the following as the top 5: financial engineering, mortgage lenders not paying attention to risk because they sold their loans instead of keeping them on balance sheet, the use of off-balance sheetactivities that avoided reserve and capital requirements, high investment bank leverage,and in ated housing price beliefs. By contrast the bottom 5 factors were strategic default by underwater borrowers, the revolving door between industry and regulators, banks knowingly engaging in excessive risky lending because they knew the government would bail them out, loose monetary policy and government policies promoting homeownership.

Figure 10: Factors Contributing to the Financial Crisis

Interestingly, academics and market participants differed on the importance of lax regulation as a factor in the financial crisis. In a 2017 survey by the Initiative for Global Markets at the University of Chicago School of Business, academics ranked financial sector regulation and supervision as the most important factor (of 12) that led to the financial crisis. By contrast, participants in the BFFS 2018 Financial Risk and Regulation Survey ranked lax regulatory oversight 12th out of 19.

Short-term and Long-term Response to the Financial Crisis

Participants were generally supportive of both the government's immediate and long-term responses to the financial crisis. 50% assessed the government response as effective and 64% assessed the Federal Reserve's response as effective. When asked to compare the effectiveness of the U.S. response, 75% stated that it was somewhat more or much more effective than other countries such as the United Kingdom and Germany. Only 30% stated that the U.S. government should have bailed out Lehman Brothers.

This is in line with participants' generally positive views for a role for government intervention in financial markets, particularly for the purpose of financial stability. 69% agreed somewhat or completely with the statement: \Government regulation is necessary and beneficial." 67% answered that the purpose of financial regulation is financial stability.

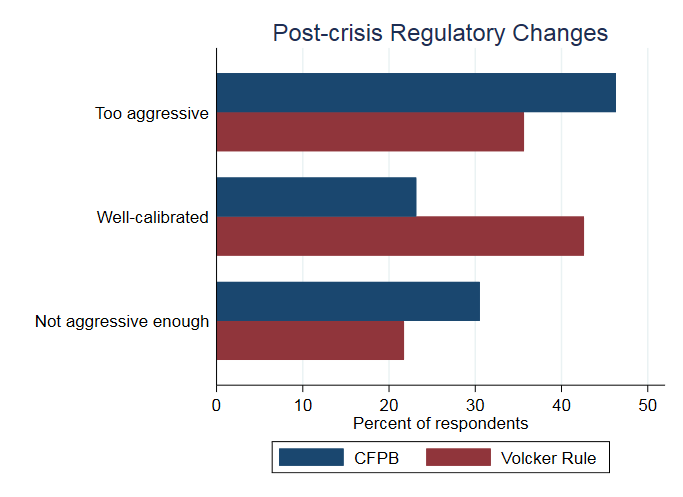

Overall, 67% of respondents stated that attempts to address the factors that led to the financial crisis were somewhat or very effective. Nevertheless, only 10% of participants thought the regulatory response over the past 10 years was well calibrated. 49% stated that there had been too many regulatory requirements in some areas and too few in others. Participants particularly disagreed on whether various parts of the Dodd-Frank act were well-calibrated or too aggressive. 54% indicated the Dodd-Frank Act was too aggressive while 30% believed it was well-calibrated and 16% stated it was not aggressive enough. Similarly, 45% stated that the Bureau of Consumer Financial Protection was too aggressive, and 31% states it was not aggressive enough. 35% stated the Volcker rule was too aggressive and 22% stated it was not aggressive enough.

Figure 11: Post-crisis Regulatory Changes

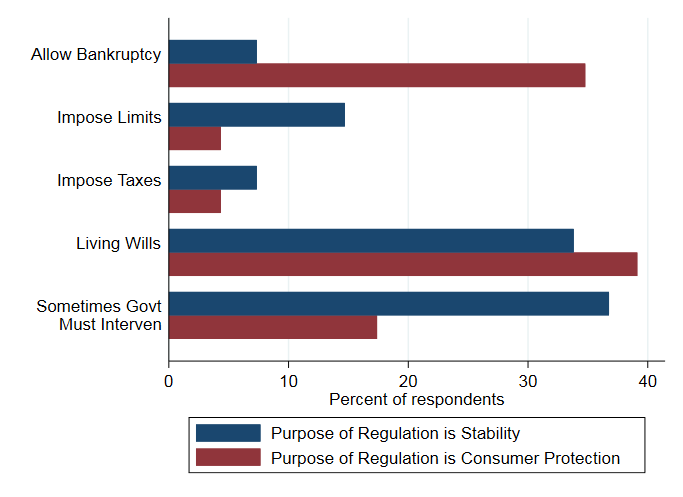

Unsurprisingly, respondents differed on the best way to approach the issue of "too big to fail", the idea that some financial institutions are too large and interconnected to be allowed to fail, and that the government should play a role in rescuing them to avoid their failure. Interestingly, whether respondents believed the government should sometimes intervene was closely related to whether they believed the purpose of financial regulation was financial stability or consumer protection. Of those who chose financial stability, 37% states that the government must sometimes intervene and only 6% stated "No institutions is too big to fail. The government should allow institutions to go bankrupt." By contrast, of those who chose consumer protection, 35% agreed wtih bankruptcy and only 17% agreed with the idea that "too big to fail" cannot be resolved and sometimes, the government must intervene. Interestingly, approximately one third of each group of respondents saw the creation of living will plans that allow banks to fail without bringing down the system as the best solution. This is the solution that was implemented as part of the Dodd-Frank Act.

Figure 12: What is the Best Way to Solve too Big to Fail?

4. Conclusion and Looking Forward

The results of the 2018 Financial Risk and Regulation Survey reveal a financial system that has recovered tremendously since the lows of the financial crisis ten years ago. Intervention by the U.S. Government and Federal helped the financial system recover and new regulation had addressed at least some of the factors that led to the financial crisis. But many issues remain. Participants are split on the effectiveness of much of the Dodd-Frank Act, and are wary of risks to non-bank financial intermediaries, to which most of the post-crisis regulation does not apply.

Despite confidence in the financial system and its ability to withstand shocks, participants identified of several markets in which prices seem inflated relative to fundamentals. In addition, political turmoil and the high debt-low interest rate environment present potential ongoing and growing risks to the financial system.

As circumstances in the financial system change, old risks subside and new risks arise. By examining both the current state of the financial system and reflecting on the financial crisis, 2018 Financial Risk and Regulation Survey seeks to further our understanding of the past ten years and of future crises. Through this, and other initiatives, the Behavioral Finance and Financial Stability Project at HBS continues to support research at the forefront of understanding, predicting, and preserving financial stability.