Now at Harvard Business School: The South Sea Bubble, 1720: Narratives of the First International Crash

|

BOSTON—Harvard Business School’s (HBS) Baker Library has opened a new exhibition that focuses on the history of one of the most infamous financial crashes. “The South Sea Bubble, 1720: Narratives of the First International Crash” was organized by Baker Library Special Collections  “Des Waerelds Doen en Doolen, is Maar een Mallemoolen (The Actions and Designs of the World Go Round as if in a Mill).” Het Groote Tafereel der Dwaasheid. Amsterdam, 1720. Kress Collection, Baker Library, Harvard Business School.

A formative moment in financial history, the bubble was the result of speculative mania that swept across Great Britain and Europe in the early 18th century. British citizens from all walks of life invested in the South Sea Company, a public private enterprise that was granted a trade monopoly with Spanish colonies in South America in return for converting British government debt into company shares. In 1720, the company profits peaked before abruptly crashing. Baker Library holds one of the world’s most extensive collections relating to the 18th century financial crisis. Through original books, pamphlets, manuscripts, financial instruments, satirical prints, and broadsides, the exhibition explores the South Sea Company’s history, including:

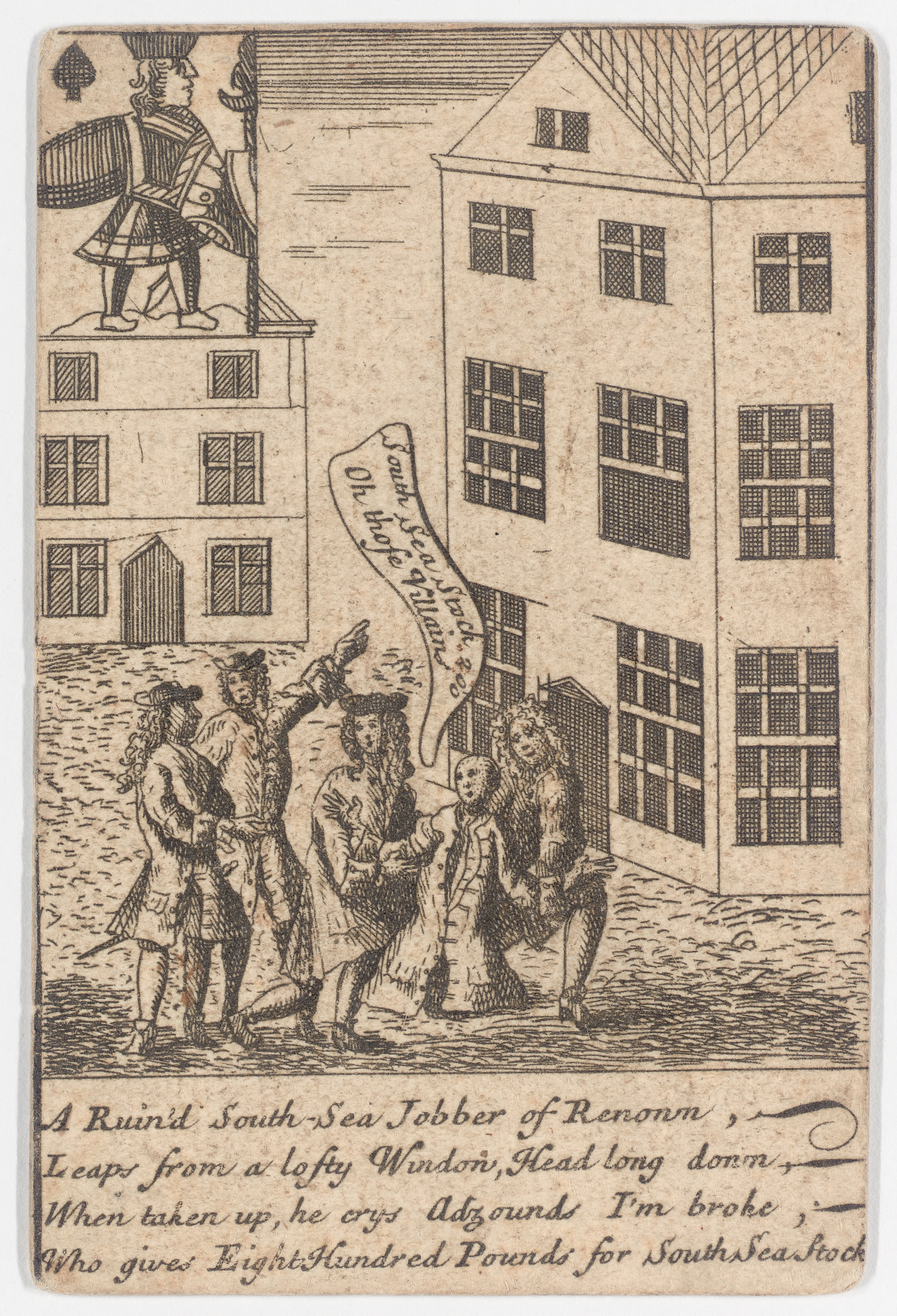

Jack of Spades. In [South Sea

Bubble Playing Cards]. London: Carington Bowles, 1721. Kress Collection, Baker Library, Harvard Business School. A Ruin'd South-Sea Jobber of Renown, / Leaps from a lofty Window, Head long down, / When taken up, he crys Adzounds I'm broke, / Who gives Eight Hundred Pounds for South Sea St More than three centuries later, the South Sea Bubble continues to survive as a cautionary tale. “The collapse marked a momentous occasion in financial history,” said Laura Linard, senior director of Baker Library Special Collections. “The exhibition sheds a light on the figures who played pivotal roles in the creation of the bubble—and those who suffered the consequences as a result.” From Parliamentary acts to satirical prints, the South Sea Bubble Collection at Baker Library reveals economic, political, cultural, and social narratives of the investor frenzy and ensuing financial collapse of 1720 that resonate to this day. The exhibition will be on display through August 2023 in the North Lobby of Baker Library | Bloomberg Center on the HBS campus in Boston. For more information on the exhibition and to see visiting hours, please visit the Baker Library website. The accompanying online research portal allows users to search in-depth an extraordinary collection that offers opportunities for multi-disciplinary research. |

About Harvard Business School

Harvard Business School, located on a 40-acre campus in Boston, was founded in 1908 as part of Harvard University. It is among the world's most trusted sources of management education and thought leadership. For more than a century, the School's faculty has combined a passion for teaching with rigorous research conducted alongside practitioners at world-leading organizations to educate leaders who make a difference in the world. Through a dynamic ecosystem of research, learning, and entrepreneurship that includes MBA, Doctoral, Executive Education, and Online programs, as well as numerous initiatives, centers, institutes, and labs, Harvard Business School fosters bold new ideas and collaborative learning networks that shape the future of business.