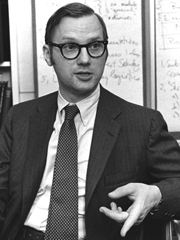

Harvard Business School Professor Charles Christenson

Dead at 80

|

BOSTON—Harvard Business School Professor Emeritus Charles J. "Chuck" Christenson, a specialist in managerial accounting and control, died last week of natural causes at his Cambridge, Mass., home at the age of 80. At the time of his death, he was the School's Royal Little Professor of Business Administration Emeritus.  Professor Emeritus Charles

Professor Emeritus Charles Christenson Photo: Baker Library Historical Collections A member of the active HBS faculty for almost 40 years, Christenson had a distinguished career as an innovator, teacher, and scholar. "He had a deep intelligence and broad training in the philosophy of science, which encompasses the social, physical, and biological sciences and examines 'how we know what we know,'" said Baker Foundation Professor Robert S. Kaplan. "Most accounting scholars are familiar with accounting and maybe economics, but Chuck pulled from diverse disciplines to understand management behavior." A disciple of the work of Sir Karl Popper, a noted British philosopher of science, Christenson was among the first to bring the social sciences into the mainstream of practical business studies in Harvard Business School's MBA Program. He taught the first-year MBA courses in Managerial Economics and Control. He also taught in the Owner/President Management Program for executives and a doctoral seminar on the theory and development of complex systems. In addition, he developed a program for the training of public officials that was offered at the Kennedy School of Government (now the Harvard Kennedy School) in the 1970s. Christenson's research focused on organizations as learning systems, corporate adaptability, and the applications of social sciences to business. "Chuck was a brilliant, gifted man, who brought a rigor and ambition to his thinking about the nature of organizations and how you derive truth from theory," said Regina E. Herzlinger, the Nancy R. McPherson Professor of Business Administration and a former student of Christenson's. "I loved the ideas that interested him," she said, recalling the "mind-stretching" books by Herbert A. Simon (who subsequently won the Nobel Prize in Economic Sciences in 1978), Popper, and others that she read in Christenson's doctoral seminar. "These were first-class works about how organizations are controlled that I never would have seen without Chuck." Christenson authored or coauthored a number of books and articles on quantitative methods, management control, and the philosophy of science. Among his publications are Management Decision Sciences: Cases and Readings (1980), Managerial Economics: Text and Cases (1973), and Strategic Aspects of Competitive Bidding for Corporate Securities (1965). Reflecting Christenson's interest in administrative systems and management control, Strategic Aspects concerned decision problems encountered by investment banking syndicates when they engaged in competitive sealed bidding for new issues of public debt securities. In an important article in the January 1983 Accounting Review, "The Methodology of Positive Accounting," he critiqued and questioned the methodology of an influential style of accounting research then in vogue. In another noted article in Decision Sciences in 1976, he examined what scholars can learn from inductive and deductive styles of research, in particular the relationship between theory and data collection and analysis. "The ideas he was trying to get at – how you apply knowledge and develop theories in managerial sciences and on managerial subjects – are timeless and still struggled with by financial scholars and economists today," said Professor Kaplan. In addition to research, course development, and teaching, Christenson served for a time as faculty chair of the School's MBA and Doctoral Programs and was head of the Control Unit in 1983. In the latter role, he played a major role in hiring promising young accounting scholars who became the unit's future leaders. One of Christenson's other accomplishments was the adaptation of compound interest tables that he developed for textbooks, according to William J. Bruns, the School's Henry R. Byers Professor of Business Administration Emeritus. The tables, produced with the late HBS professor Robert N. Anthony, taught students how to calculate the present value of a stream of future payments. "Legend has it that they deliberately put an error in their tables before publishing them to see if others copied their work — which they did," Bruns recalled with a smile. Charles John Christenson was born September 25, 1930, in Chicago. He made his first scholarly contribution at the age of only 22. Five months after graduating from Cornell in 1952 with a bachelor's degree in industrial and labor relations, he decided to submit a paper, "Legality of New Jersey's Anti-Strike Law," to the Labor Law Journal, and it was accepted. After Cornell, Christenson came to Harvard Business School as an MBA student, graduating with high distinction as a Baker Scholar in 1954. He had planned to go into investment banking, but with the encouragement of HBS professor Charles Bliss, he worked for six months as a research assistant for Professor Anthony, a giant in the field of managerial accounting. After two years of military service, during which he participated in the development of the U.S. Army's first cost-based budgetary control system, in 1957 Christenson returned to Harvard Business School, where he obtained his doctorate in business administration (DBA) in 1961 and joined the faculty. He was promoted to full professor in 1968 and served as the Thomas Henry Carroll Ford Foundation Professor from 1972 to 1973. He was appointed the first Jesse Isidor Straus Professor in 1974 and was named to the Royal Little chair in 1980. Christenson spent one year away from the School in Washington, D.C., in 1962, serving as deputy for management systems to the Assistant Secretary of the U.S. Air Force, Neil Harlan, a former HBS faculty member. During that leave of absence, he introduced new techniques for financial management into various Air Force systems. Before returning to Harvard, he received the Air Force's Exceptional Civilian Service Award in recognition of his accomplishments. Christenson was actively involved in a number of professional organizations, including the American Association for the Advancement of Science, the American Accounting Association, and the American Economics Association. He received an Accounting award from Alpha Kappa Psi, the oldest and largest professional business fraternity, in 1983. He was a director of several companies, including the Kenetech Corporation, a diversified developer, builder, and operator of independent power plants. He also served as a trustee and officer of several not-for-profit organizations, including the Telluride Association, which creates and fosters educational communities that teach leadership and service. In addition, it oversees Telluride House at Cornell, which provides both housing and a stimulating learning environment beyond class to both undergraduate and graduate students at the university. He was involved for many years with Deep Springs College in California—a two-year college established by the founder of the Telluride Association in 1917 that combines a liberal arts education with "manual labor and political deliberation." Christenson retired from the active faculty in 1996, though he returned to the School almost daily until the time of his death to work in his office in the Harvard Business School's Senior Faculty Center, traveling to and from the campus by bus. Reserved by nature, he was extraordinarily passionate and knowledgeable about music and for decades was a season ticket holder for musical organizations in Boston and New York, including the Boston Symphony Orchestra, the Metropolitan Opera, Boston Baroque, and the Opera Company of Boston. His private collection of operatic and classical recordings numbered in the thousands – " from reel-to-reel tapes to 78-inch vinyl discs to CDs. Christenson is survived by his brother, Paul, of Prairie Grove, IL; and three nephews, Roger Christenson of Lake in the Hills, IL, Rolf Burckhardt of Arlington Heights, IL, and Marc Burckhardt of Austin, TX. His sister, Beulah, predeceased him in 1998. A private memorial service will be held in Chicago. Donations in his memory may be sent to Boston Baroque, 68 Leonard Street, Belmont, Massachusetts 02478 (bostonbaroque.org/giving.contribute.gift). |

About Harvard Business School

Harvard Business School, located on a 40-acre campus in Boston, was founded in 1908 as part of Harvard University. It is among the world's most trusted sources of management education and thought leadership. For more than a century, the School's faculty has combined a passion for teaching with rigorous research conducted alongside practitioners at world-leading organizations to educate leaders who make a difference in the world. Through a dynamic ecosystem of research, learning, and entrepreneurship that includes MBA, Doctoral, Executive Education, and Online programs, as well as numerous initiatives, centers, institutes, and labs, Harvard Business School fosters bold new ideas and collaborative learning networks that shape the future of business.